Elon Musk: starting short-seller "Tsunami of Hurt" Part 2?

Full disclosure: We are bullish, long-term investors in Tesla Motors (TSLA). We also own a Tesla Model S and are currently on the wait list for the Model X and Powerwall.

Way back when Tesla Motors stock was trading in the high 20s in 2012, it was very popular to be bearish on TSLA. A high percentage of investors were shorting the stock. How high? We've got a historical video from September 2012 to explain (coming shortly). Investors were, en masse, betting that TSLA's stock would fall.

Did this upset Tesla CEO Elon Musk? Hard to say. It certainly got his attention. In fact, in an interview, Musk told Fox Business reporter Liz Claman: “I think it’s very unwise to be shorting Tesla... There’s a tsunami of hurt coming for those holding a short position. It’s going to be very unpleasant. I advise people to exit while there is still time.”

For context, let's take a look at this historical TSLA chart (see below) highlighting the company's year-end stock prices. It's clear that Musk was not kidding.

|

|

Source: Tesla Motors

Next, let's take a look at that historical video of Elon Musk as he makes such a provocative statement...

Source: Every Elon Musk Video via Fox Business, September 13, 2012)

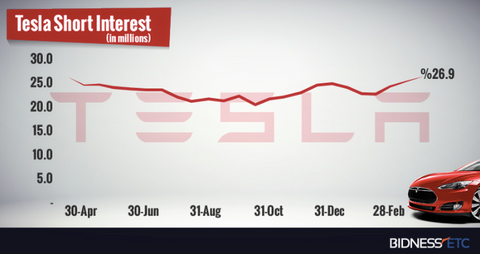

Let's fast-forward to last week, according to Bloomberg (as reported in Bidness ETC): "short interest in Tesla stock has crept up to a one year high." De ja vu? Check out the chart below. Bidness continues: "As sellers scramble to cover their short positions, Tesla’s average daily trading volume suggests it could take them about five and a half days to cover their positions – during which they’ll only add more fuel to the bullish rally.

|

Source: Bidness ETC

Now... with the huge news surrounding Tesla Energy, might we be looking at a short-seller "Tsunami of Hurt" Part 2? Only a few analysts have weighed in. Credit Suisse analyst Dan Galves explained yesterday that, "this secondary business [Tesla Energy] substantially de-risks the gigafactory, the car business, and Tesla’s valuation... and sets the stock up for a strong run over the next 12 months." Analyst Dan Dolev at Jefferies explains that Tesla's "relentless drive to improve battery energy storage capacity" results in key competitive advantage. And today, Benzinga reports: "Morgan Stanley believes that Tesla's energy storage solution could completely overturn the multi-trillion-dollar worldwide motor vehicle sector, as well as the trillion-dollar electric utility sector."

We look forward to seeing how this all unfolds. And, we probably wouldn't be surprised to see continuing volatility in the stock. Definitely some "ups and downs" in the coming months (and years) ahead. However, one thing is for sure -- based on the history lesson outlined in this post, I certainly wouldn't want to bet against Elon Musk.