Tesla is growing into an "energy innovation" company

What if Tesla was more than just a car company? Let's rewind to 2014 when Tesla Motors Founder and CTO, J.B. Straubel said: “I really love batteries. I might love batteries more than cars… We [Tesla] are an energy innovation company as much as a car company.”

Now... let's fast-forward to today, according to Bloomberg, Tesla will announce a home battery and a “very large” utility-scale battery on April 30, according to Jeffrey Evanson, Tesla’s head of investor relations. Tesla Motors (TSLA) shares rose 4.8% today to close at $219.44, the biggest daily gain in more than two weeks.

What does all this mean? According to the Verge: "Tesla Motors is really a battery company in aluminum clothing. Just like razors are vehicles for blades, Tesla’s cars are just intelligent battery systems on wheels. Tesla’s SolarCity ties, its advanced battery 'Gigafactory,' and its soon-to-be-announced home and large-scale utility batteries make for a compelling argument." And Wired magazine seems to agree: "Tesla is admired for building the cars of the future. But it’s not really a car company. It’s a battery company that happens to make electric cars."

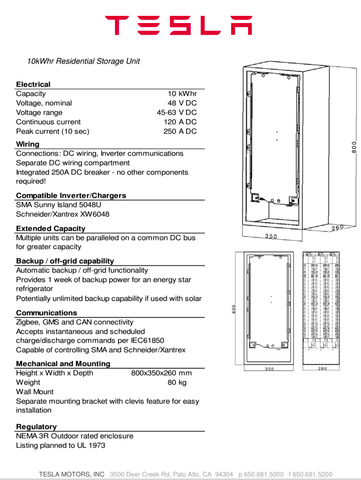

First, let’s take a look at the home battery solution already being tested in about 300 homes via SolarCity (where Elon Musk is Chairman).

|

|

Source: Tesla Motors / Gas2

Taking a look at the market, there are already about 12 million backup generators across the U.S. With that in mind, let’s take a look at a Tesla home battery, in action, inside a SolarCity house during a blackout…

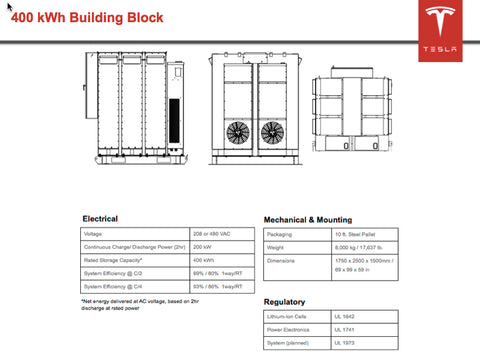

Next, let's take a look at bigger, commercial uses for battery storage -- what might Tesla's solution look like for businesses? J.B. Straubel did reveal some telling images (along with those surprising comments) back in 2014…

|

|

Source: Greentech Media

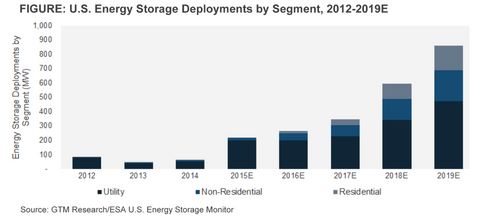

And today, according to Bloomberg, “thanks to state incentives and advances in battery chemistry, storage is a hot industry. By 2019, total U.S. sales will reach $1.5 billion, about 11 times as much as in 2014, according to a March report from GTM Research*. ‘Tesla has been able to install more than 100 projects, really without anyone noticing,’ said Andrea James, an analyst with Dougherty & Co. She said Tesla’s energy storage business could be worth as much as $70 to Tesla’s stock.” Wal-mart is already testing Tesla’s commercial battery storage solution in 11 stores. Food processing company Cargill, schools, and wineries are also reported in Bloomberg utilizing Tesla’s commercial battery storage.

|

*Source: GTM Research

Perhaps Tesla’s utility-scale battery may be in-the-works (or being explored) as reported by Dallas Morning News, “Utility-scale batteries have been a holy grail within the energy sector for years… But Oncor [which runs Texas’ largest power line network] believes it can make the economics work. Executives have already begun discussions with manufacturers including Tesla, the California-based electric car company that is building what it claims is the world’s largest battery factory in Nevada... A Tesla spokeswoman said its technology would be ready for the application planned by Oncor. Its 'gigafactory' is scheduled to open in 2017, and 30 percent of production will be set aside for utility-size batteries, she said."

Deutsche Bank analyst Rod Lache notes that energy storage represents a significant opportunity for Tesla, "we believe that the economics are already quite favorable... if Tesla could equip just 50% of SolarCity customers with 10kWh battery storage systems by 2018, this could translate into up to $1.5 bn of revenue for Tesla. Tesla is planning to dedicate 30% (15GW) of their Gigafactory’s capacity to stationary batteries in the future. At a price of $300/kWh this could eventually translate to $4.5 bn annual revenue."

Back to Straubel's comments in 2014, the Tesla CTO stated "we should all be thinking bigger" and that stationary energy storage could grow faster than automotive batteries, "maybe this whole group is not thinking in large enough scale for the market size of energy storage.”